Picture this: you’re at your favorite Dallas restaurant, confidently ordering that perfectly grilled steak you’ve been craving for months. No more worrying about loose dentures or avoiding foods you love. Full mouth dental implants can transform your life, but the investment often feels overwhelming. Here’s the good news—flexible payment plans are making this life-changing treatment more accessible than ever for Dallas families.

The reality is that full mouth dental implants represent one of the most significant investments you’ll make in your health and confidence. While the upfront cost might seem daunting, understanding your payment options can turn this dream into an achievable goal. Let’s explore how you can restore your smile without breaking the bank.

Key Takeaways

- Multiple financing options are available for full mouth dental implants, including in-house payment plans, third-party financing, and insurance coverage

- Monthly payments can range from $200-$800 depending on your treatment plan and financing terms

- Zero-interest promotions are often available for qualified patients, making treatment more affordable Flexible terms allow you to choose payment schedules that fit your budget, from 12 months to 7+ years

- Early planning and understanding all your options can significantly reduce your overall treatment costs

Understanding Full Mouth Dental Implants Payment Plans

When we talk about full mouth dental implants payment plans, we’re discussing structured financing options that break down your treatment cost into manageable monthly payments. Think of it like financing a car or home improvement project—you get the immediate benefit while spreading the investment over time.

Most dental practices, including those serving the Dallas area, understand that the cost of full mouth dental implants can be substantial. That’s why they’ve partnered with financing companies and developed in-house payment programs to make treatment accessible to more patients.

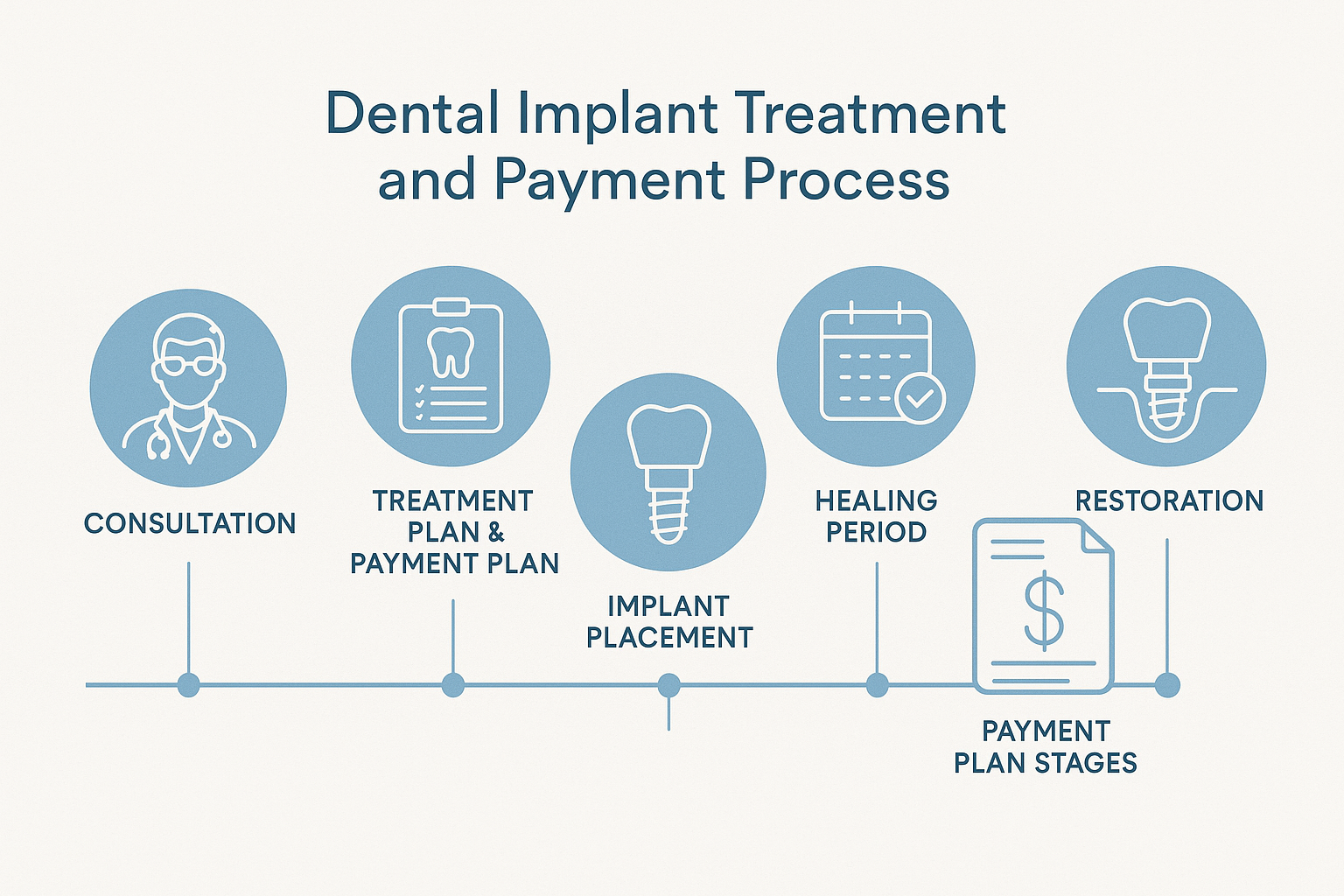

How Payment Plans Work

Your journey typically starts with a consultation where your dentist will:

- Assess your oral health and determine the best treatment approach

- Provide a detailed treatment plan with transparent pricing

- Present financing options tailored to your budget

- Help you choose the payment plan that works best for your situation

The beauty of modern full mouth dental implants payment plans is their flexibility. You’re not locked into a one-size-fits-all approach—instead, you can customize your payments based on your financial comfort zone.

Types of Financing Options Available

In-House Payment Plans

Many dental practices offer their own financing programs, which often provide the most flexibility. These plans typically feature:

- No credit checks for certain programs

- Low or zero interest for qualified patients

- Flexible terms ranging from 6 months to several years

- Direct communication with your dental team about payment concerns

Third-Party Financing Companies

Popular healthcare financing companies like CareCredit, LendingClub, and Prosper Healthcare Lending specialize in medical and dental treatments. These options often provide:

- Immediate approval decisions

- Promotional periods with 0% interest

- Extended payment terms up to 84 months

- Online account management for easy payment tracking

Insurance and HSA/FSA Options

While traditional dental insurance may not cover the full cost of implants, you might be surprised by what’s available:

- Medical insurance may cover portions related to accident or medical necessity

- HSA and FSA funds can be used for implant treatments

- Dental savings plans offer discounted rates for members

- Employer benefits sometimes include enhanced dental coverage

Breaking Down the Costs: What to Expect

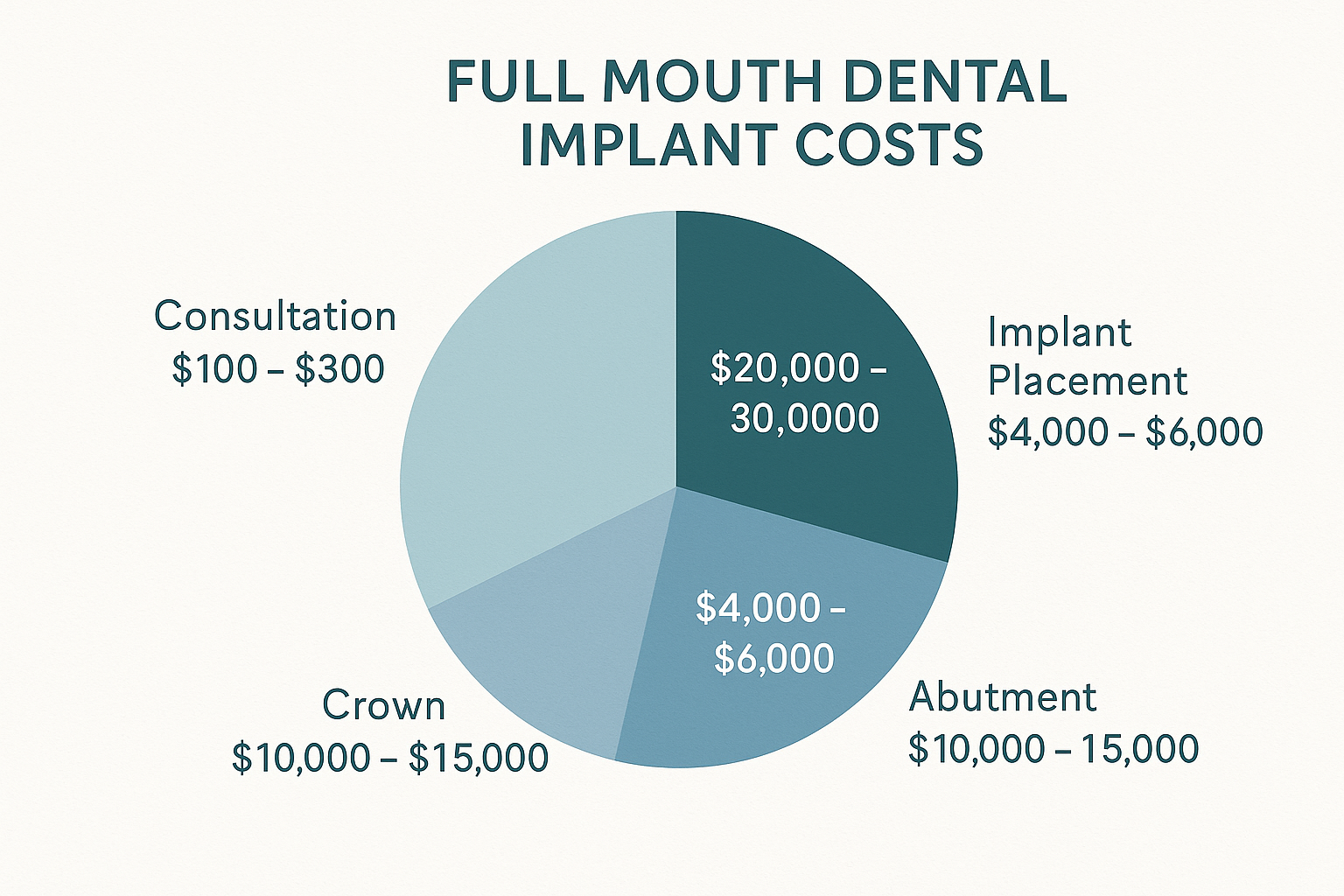

Understanding the full mouth implant surgery cost helps you make informed decisions about financing. Here’s a realistic breakdown of what you might encounter in the Dallas area:

Treatment Components and Pricing

| Treatment Component | Typical Range |

|---|---|

| Initial consultation and planning | $200 – $500 |

| Full mouth implant surgery | $15,000 – $30,000 |

| Temporary prosthetics | $2,000 – $5,000 |

| Final restoration | $10,000 – $25,000 |

| Total Investment | $25,000 – $60,000 |

Sample Payment Plan Scenarios

Let’s look at how different financing options might work for a $35,000 treatment:

Option 1: 24-Month Plan at 0% Interest

- Monthly payment: $1,458

- Total cost: $35,000

Option 2: 60-Month Plan at 6.9% Interest

- Monthly payment: $688

- Total cost: $41,280

Option 3: 84-Month Plan at 9.9% Interest

- Monthly payment: $531

- Total cost: $44,604

💰 Full Mouth Dental Implants Payment Calculator

Qualifying for Full Mouth Dental Implants Payment Plans

Getting approved for financing doesn’t have to be stressful. Most full mouth dental implants payment plans are designed to accommodate various financial situations. Here’s what you need to know about qualifying:

Credit Score Requirements

Excellent Credit (720+):

- Access to the best interest rates

- Longer payment terms available

- Higher approval amounts

- Promotional 0% interest periods

Good Credit (650-719):

- Competitive rates available

- Standard payment terms

- Most financing options accessible

Fair Credit (580-649):

- Higher interest rates but still manageable

- Shorter payment terms

- May require co-signer or larger down payment

Poor Credit (Below 580):

- In-house financing often available

- Alternative lenders specialize in poor credit

- Focus on income verification over credit score

Income and Employment Verification

Lenders typically look for:

- Stable employment history (2+ years preferred)

- Sufficient income to cover monthly payments

- Debt-to-income ratio below 40-50%

- Proof of income through pay stubs or tax returns

💡 Pro Tip: Even if your credit isn’t perfect, don’t let that stop you from exploring affordable local full mouth dental implants. Many Dallas practices work with patients of all credit backgrounds.

Maximizing Your Payment Plan Benefits

Timing Your Treatment Strategically

Start of the Year: If you have an HSA or FSA, beginning treatment early in the year maximizes your available funds.

End of Year: Some practices offer promotions during slower periods, potentially reducing your overall cost.

Tax Season: Using tax refunds as down payments can significantly reduce monthly obligations.

Negotiating Better Terms

Don’t be afraid to discuss your options. Many practices are willing to:

- Match competitor financing offers

- Adjust payment schedules to fit your budget

- Combine multiple treatments for better overall pricing

- Offer cash discounts if you can pay larger portions upfront

Understanding Promotional Periods

Many financing companies offer 0% interest periods ranging from 6-24 months. To maximize these benefits:

- Pay more than the minimum to reduce principal faster

- Set up automatic payments to avoid late fees

- Understand the terms completely before signing

- Have a payoff strategy before the promotional period ends

Comparing Different Financing Providers

CareCredit

Pros:

- Widely accepted by dental practices

- Multiple promotional periods available

- Online account management

- No prepayment penalties

Cons:

- High interest rates after promotional periods

- Deferred interest can be costly

- Credit requirements can be strict

LendingClub Patient Solutions

Pros:

- Fixed interest rates

- No prepayment penalties

- Quick approval process

- Transparent fee structure

Cons:

- Limited promotional offers

- May require good credit for best rates

In-House Financing

Pros:

- More flexible approval criteria

- Direct relationship with your dental team

- Often interest-free options

- Customizable payment schedules

Cons:

- Limited to specific practice

- May require larger down payments

- Less regulatory protection

Special Considerations for Dallas Patients

Living in the Dallas area provides unique advantages when seeking full mouth teeth implants financing:

Local Practice Benefits

Dallas dental practices often offer:

- Competitive pricing due to market competition

- Flexible scheduling to accommodate working professionals

- Multiple financing partnerships providing more options

- Community connections that may lead to special programs

Regional Insurance Considerations

Texas residents should be aware of:

- State-specific insurance regulations that may affect coverage

- Regional insurance providers offering dental benefits

- Employer-sponsored plans common in the Dallas business community

Making the Most of Your Investment

Remember, full mouth dental implants payment plans aren’t just about managing costs—they’re about investing in your future. Consider the long-term value:

Health Benefits

- Improved nutrition from being able to eat all foods

- Better oral health preventing future dental problems

- Preserved facial structure maintaining a youthful appearance

Lifestyle Improvements

- Increased confidence in social and professional situations

- No more denture adhesives or daily removal routines

- Freedom to eat your favorite foods without worry

Financial Perspective

When you calculate the full arch replacement cost over time, implants often prove more economical than repeatedly replacing dentures or bridges.

Red Flags to Avoid

While exploring full mouth dental implants payment plans, watch out for:

Predatory Lending Practices

- Extremely high interest rates (above 25-30%)

- Hidden fees not disclosed upfront

- Pressure tactics to sign immediately

- Unrealistic payment promises

Too-Good-to-Be-True Offers

- Guaranteed approval regardless of credit

- No down payment with poor credit

- Lifetime payment plans with no end date

- Verbal agreements without written contracts

Working with Your Dental Team

Your dental practice should be your partner in finding the right financing solution. Look for teams that:

Provide Transparency

- Clear, written estimates for all treatment phases

- Detailed explanation of all financing options

- No pressure to choose expensive options

- Honest discussion about your budget constraints

Offer Support Throughout Treatment

- Payment plan flexibility if circumstances change

- Clear communication about upcoming payments

- Assistance with insurance claims and documentation

- Ongoing financial counseling as needed

Planning for Success

Before You Commit

- Get multiple consultations to compare treatment plans and costs

- Review all financing options thoroughly

- Calculate total costs including interest and fees

- Ensure monthly payments fit comfortably in your budget

- Understand the complete timeline for treatment and payments

During Treatment

- Keep detailed records of all payments and treatments

- Communicate immediately if payment issues arise

- Take advantage of any available discounts or promotions

- Stay on schedule with both treatments and payments

After Treatment

- Continue payments as agreed to maintain good credit

- Keep up with maintenance to protect your investment

- Refer friends and family who might benefit from similar treatment

Alternative Funding Strategies

Dental Schools and Training Programs

Consider treatment at accredited dental schools where:

- Supervised students provide care at reduced costs

- Payment plans are often more flexible

- Quality standards remain high due to supervision

Dental Tourism Considerations

While some patients consider treatment abroad, remember:

- Follow-up care challenges when complications arise

- Quality variations in materials and techniques

- Total costs including travel may not provide savings

- Limited recourse if problems develop

Employer Benefits and Assistance Programs

Some Dallas employers offer:

- Enhanced dental benefits during open enrollment

- Health savings account contributions

- Employee assistance programs with financial counseling

- Flexible spending arrangements for medical expenses

Looking Ahead: The Future of Dental Financing

The landscape of full mouth dental implants payment plans continues evolving with:

Technology Integration

- AI-powered approval processes for faster decisions

- Mobile payment apps for easier account management

- Telemedicine consultations reducing travel costs

- Digital treatment planning improving accuracy and reducing costs

Expanded Options

- Subscription-based dental care models

- Peer-to-peer lending platforms

- Cryptocurrency payment options

- Government assistance programs for seniors and veterans

Conclusion

Achieving your dream smile through full mouth dental implants doesn’t have to remain just a dream. With the variety of full mouth dental implants payment plans available in 2025, you can find a financing solution that fits your budget and lifestyle.

The key is understanding your options, working with a trusted dental team, and choosing a payment plan that allows you to comfortably invest in your oral health. Whether you qualify for 0% interest financing or need a longer-term payment plan, the right solution exists for your situation.

Remember, this investment goes beyond just improving your smile—it’s about restoring your confidence, improving your health, and enhancing your quality of life. When you consider the long-term benefits and the flexible financing options available, full mouth dental implants become an achievable goal rather than an impossible dream.

Ready to take the next step? Start by scheduling a consultation with a qualified Dallas dental implant specialist. They can provide a personalized treatment plan and help you explore all available financing options. Your journey to a confident, healthy smile can begin today with the right payment plan supporting your goals.

Don’t let financial concerns prevent you from getting the smile you deserve. With proper planning and the right financing partner, you can begin your transformation and start enjoying the life-changing benefits of full mouth dental implants sooner than you think.

Leave a Reply

Share your thoughts or ask a question about dental implants. Your email address will not be published.