Did you know that over 120 million Americans are missing at least one tooth, yet many delay treatment because they believe their poor credit score will prevent them from accessing financing? 🦷 The truth is, dental implant financing bad credit approved options are more available than ever in 2025, and I’m here to show you exactly how to secure the funding you need for your smile transformation.

Whether you’re dealing with a credit score below 600 or have faced financial challenges in the past, there are legitimate pathways to get approved for dental implant financing. In this comprehensive guide, I’ll walk you through proven strategies, specific lenders who work with bad credit patients, and insider tips that can help you secure approval even when traditional financing seems out of reach.

Key Takeaways

• Multiple financing options exist specifically for patients with poor credit, including in-house dental plans, specialized medical lenders, and alternative financing solutions

• Credit scores as low as 580 can still qualify for certain dental financing programs, with some lenders focusing more on income than credit history

• In-house financing plans offered directly by dental practices often have the most flexible approval criteria and may not require traditional credit checks

• Government assistance programs and dental schools provide additional pathways for affordable implant treatment regardless of credit status

• Proper preparation and documentation can significantly improve your chances of approval, even with bad credit

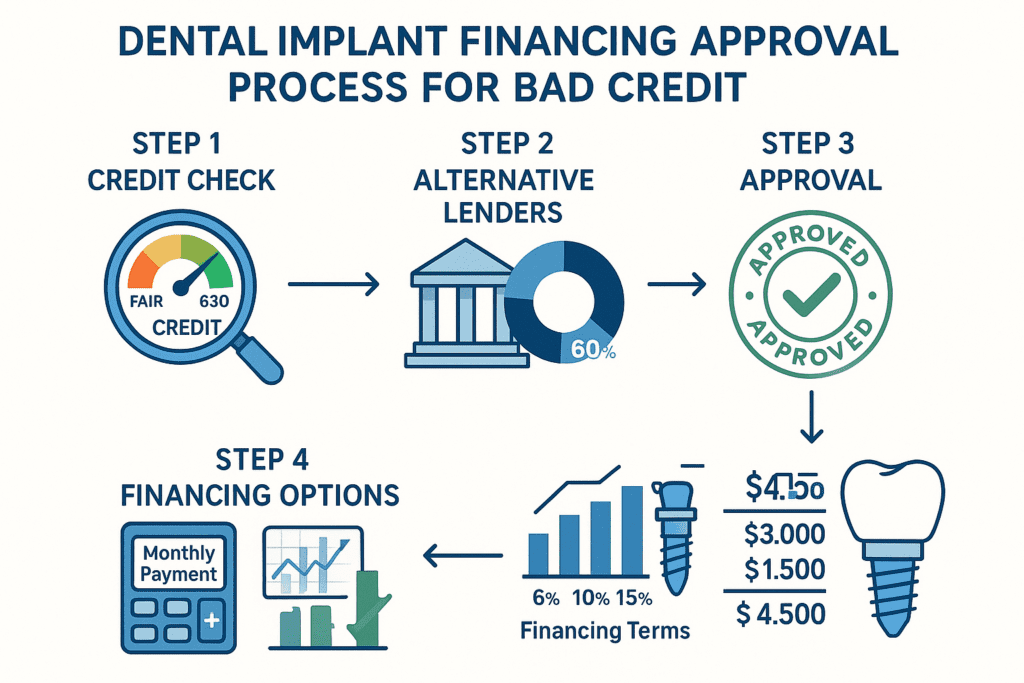

Understanding Dental Implant Financing with Bad Credit

What Constitutes “Bad Credit” for Dental Financing?

When we talk about dental implant financing bad credit approved options, it’s important to understand what lenders consider “bad credit.” Generally, credit scores fall into these categories:

- Excellent: 750-850

- Good: 700-749

- Fair: 650-699

- Poor: 550-649

- Bad: Below 550

However, many dental financing companies have more lenient criteria than traditional lenders. Some specialized medical financing companies will approve patients with scores as low as 580, and certain in-house dental financing programs don’t require credit checks at all.

Why Traditional Financing Often Fails

Traditional bank loans and credit cards typically require good to excellent credit scores, making them inaccessible for many patients who need dental implants. Banks view dental procedures as elective rather than emergency medical care, which increases their lending requirements.

This is where specialized dental implant financing bad credit approved programs become invaluable. These lenders understand that dental health is essential and have developed approval criteria that look beyond just credit scores.

Top Dental Implant Financing Options for Bad Credit Approval

In-House Dental Financing Plans

Many dental practices now offer their own financing programs, which often provide the best approval rates for patients with poor credit. These plans typically feature:

Advantages:

- No third-party credit checks in many cases

- Flexible payment terms tailored to your budget

- Direct relationship with your dental provider

- Often 0% interest for qualified periods

How to Qualify:

- Steady income verification

- Valid identification and contact information

- Down payment (usually 10-25% of treatment cost)

- Commitment to treatment plan

When exploring affordable dental implants in Dallas, many practices offer these flexible in-house options that can work around credit challenges.

Specialized Medical Credit Cards

Several credit card companies focus specifically on healthcare financing and have more lenient approval criteria:

CareCredit:

- Accepts applicants with fair to poor credit

- Promotional 0% APR periods available

- Instant approval decisions

- Can be used for multiple dental procedures

Lending Club Patient Solutions:

- Alternative underwriting that considers income and employment

- Fixed monthly payments

- No prepayment penalties

- Covers up to $40,000 in treatment costs

Third-Party Medical Lenders

These companies specialize in healthcare financing and often approve patients that traditional lenders reject:

| Lender | Minimum Credit Score | Max Loan Amount | Special Features |

|---|---|---|---|

| Prosper Healthcare | 580 | $40,000 | Income-based approval |

| United Medical Credit | No minimum stated | $25,000 | Same-day approval |

| Alphaeon Credit | 600 | $30,000 | Cosmetic procedure focus |

| iCare Financial | 550 | $20,000 | Bad credit specialists |

Dental Savings Plans and Membership Programs

While not traditional financing, these programs can significantly reduce the cost of All-on-4 dental implants and other procedures:

- Annual membership fees typically range from $100-300

- Discounts of 20-50% on major procedures

- No credit checks required

- Immediate activation in most cases

Strategies to Improve Your Approval Chances

Documentation That Strengthens Your Application

When applying for dental implant financing bad credit approved programs, proper documentation can significantly improve your approval odds:

Essential Documents:

- Pay stubs from the last 2-3 months

- Bank statements showing consistent deposits

- Tax returns for self-employed applicants

- Employment verification letter

- List of monthly expenses and existing debts

Income-to-Debt Ratio Optimization

Many alternative lenders focus more on your ability to repay than your credit history. To improve your chances:

- Calculate your debt-to-income ratio (should be below 40%)

- Pay down existing debts before applying

- Include all sources of income (part-time work, benefits, etc.)

- Consider a co-signer with better credit

Timing Your Application Strategically

The timing of your financing application can impact approval rates:

- Apply during weekdays when underwriters are fully staffed

- Avoid holiday periods when approval processes may be delayed

- Submit applications early in the month when lenders have fresh quotas

- Complete applications in one sitting to avoid incomplete submissions

Alternative Funding Sources for Dental Implants

Dental Schools and Training Programs

Dental schools offer significantly reduced costs for implant procedures, making them accessible even without financing:

Benefits:

- 50-75% cost reduction compared to private practice

- Supervised treatment by experienced faculty

- Access to latest techniques and technology

- No credit requirements for payment plans

Considerations:

- Longer treatment times due to educational process

- Multiple appointments for each procedure phase

- Limited availability and waiting lists

For those exploring affordable All-on-4 dental implants, dental schools can provide excellent value while maintaining quality care.

Government Assistance Programs

Several government and non-profit programs can help with dental implant costs:

Medicaid Coverage:

- Some states cover implants for medical necessity

- Prior authorization typically required

- Must meet specific medical criteria

Veterans Benefits:

- VA dental benefits for service-connected conditions

- Comprehensive dental care for certain veterans

- May cover full mouth reconstruction including implants

State-Specific Programs:

- Low-income dental assistance programs

- Community health center sliding fee scales

- Charitable care programs at hospitals

Crowdfunding and Community Support

Modern fundraising platforms have made it easier to raise money for medical procedures:

Popular Platforms:

- GoFundMe Medical – specifically for healthcare costs

- YouCaring – focuses on medical and emergency needs

- CaringBridge – combines updates with fundraising

Success Tips:

- Share your story authentically and personally

- Include photos and treatment plans

- Leverage social media networks

- Provide regular updates to donors

Working with Dental Practices for Flexible Payment Options

Negotiating In-House Payment Plans

Many dental practices are willing to work directly with patients to create affordable payment arrangements. When discussing dental implant financing, consider these negotiation strategies:

Effective Negotiation Tactics:

- Be upfront about your financial situation – honesty builds trust

- Propose a realistic payment schedule based on your budget

- Offer a larger down payment in exchange for better terms

- Ask about cash discounts for upfront payment

- Inquire about seasonal promotions or financing specials

Treatment Phasing to Spread Costs

Rather than financing the entire treatment at once, many patients benefit from phasing their implant treatment:

Phase 1: Essential Implants

- Address most visible or problematic teeth first

- Establish payment history with the practice

- Allow time to save for subsequent phases

Phase 2: Remaining Implants

- Complete the treatment plan over 6-12 months

- Take advantage of improved credit from Phase 1 payments

- Potentially qualify for better financing terms

This approach is particularly effective for complex treatments like All-on-6 dental implants where the total cost can be substantial.

Building Relationships with Dental Financial Coordinators

Dental practices often employ financial coordinators who specialize in helping patients navigate dental implant financing bad credit approved options. These professionals can be invaluable allies:

How to Work Effectively with Financial Coordinators:

- Schedule dedicated time to discuss financing options

- Bring complete financial documentation to your consultation

- Ask about all available programs – they may know options you haven’t considered

- Maintain open communication throughout the approval process

Understanding Interest Rates and Terms for Bad Credit Financing

Typical Interest Rate Ranges by Credit Score

Understanding what to expect can help you evaluate financing offers more effectively:

| Credit Score Range | Typical APR Range | Approval Likelihood |

|---|---|---|

| 750+ (Excellent) | 5.9% – 8.9% | 95%+ |

| 700-749 (Good) | 8.9% – 12.9% | 85-95% |

| 650-699 (Fair) | 12.9% – 18.9% | 70-85% |

| 550-649 (Poor) | 18.9% – 24.9% | 50-70% |

| Below 550 (Bad) | 24.9% – 35.9% | 30-50% |

Hidden Fees to Watch For

When evaluating dental implant financing bad credit approved offers, be aware of potential additional costs:

Common Fees:

- Origination fees (1-8% of loan amount)

- Late payment penalties (typically $25-50)

- Prepayment penalties (rare but worth checking)

- Annual fees for credit cards

- Processing fees for applications

Promotional Financing Offers

Many dental financing companies offer promotional rates that can significantly reduce costs:

0% APR Promotions:

- Typically 6-24 months for qualified applicants

- Must pay off balance during promotional period

- Deferred interest may apply if not paid in full

Extended Payment Plans:

- Lower monthly payments over longer terms

- Higher total interest paid over loan life

- Good for budget management but costlier overall

Red Flags and Scams to Avoid

Predatory Lending Warning Signs

Unfortunately, patients with bad credit are often targets for predatory lenders. Watch for these warning signs:

Red Flags:

- Guaranteed approval regardless of credit or income

- Upfront fees required before approval

- Pressure to sign immediately without review time

- Excessive interest rates above 36% APR

- No physical address or legitimate contact information

Legitimate vs. Questionable Lenders

Legitimate Lenders Typically:

- Have proper licensing in your state

- Provide clear terms and conditions

- Offer reasonable interest rates for your credit level

- Allow time for application review

- Have positive reviews and BBB ratings

Questionable Lenders Often:

- Make unrealistic promises

- Require payment before services

- Have numerous consumer complaints

- Lack proper licensing or credentials

- Use high-pressure sales tactics

Building Credit While Paying for Dental Implants

Using Dental Financing to Improve Credit Scores

Successfully managing dental implant financing bad credit approved can actually help improve your credit score over time:

Credit Building Strategies:

- Make all payments on time – payment history is 35% of your credit score

- Pay more than the minimum when possible

- Keep credit utilization low if using credit cards

- Don’t close accounts after paying them off

- Monitor your credit report for improvements

Timeline for Credit Score Improvement

With consistent, on-time payments for your dental implant financing, you can expect:

3-6 Months:

- Initial positive payment history established

- Small improvements in credit score (10-20 points)

6-12 Months:

- More substantial score improvements (20-50 points)

- Potential qualification for better financing terms

12+ Months:

- Significant credit score gains possible (50+ points)

- Access to prime lending rates for future needs

Understanding the healing stages after dental implant surgery can help you plan your payment schedule around your recovery timeline.

State-Specific Resources and Programs

Regional Financing Programs

Many states offer specific programs to help residents access dental care:

Texas Programs:

- Texas Health Steps – Medicaid program covering some dental implants

- Community Health Centers – sliding fee scales based on income

- Dental Lifeline Network – free care for disabled and elderly patients

California Programs:

- Denti-Cal – limited implant coverage for medical necessity

- California Dental Association Foundation – charitable care programs

- Free and Charitable Clinics – throughout major metropolitan areas

Local Dental Societies and Charitable Organizations

Many local dental societies sponsor programs to help patients access care:

- Give Kids a Smile programs (some include adult services)

- Mission of Mercy events providing free care

- Local dental society charitable foundations

- Religious organization health ministries

Planning Your Dental Implant Treatment Timeline

Coordinating Financing with Treatment Phases

Successful dental implant treatment requires careful coordination between financing approval and treatment scheduling. Understanding the typical timeline helps with financial planning:

Phase 1: Consultation and Planning (Weeks 1-2)

- Initial examination and treatment planning

- Financing application submission

- Insurance verification and pre-authorization

Phase 2: Preparatory Work (Weeks 3-8)

- Tooth extractions if needed

- Bone grafting procedures when necessary

- Healing period (4-6 weeks for extractions)

Phase 3: Implant Placement (Weeks 9-10)

- Surgical implant placement

- Temporary restoration if appropriate

- Initial healing period begins

Phase 4: Healing and Integration (Months 3-6)

- Osseointegration period

- Regular follow-up appointments

- Continued financing payments

Phase 5: Final Restoration (Months 6-7)

- Abutment placement

- Final crown or prosthetic fitting

- Treatment completion

Managing Payments During Treatment

Payment Strategy Tips:

- Align payment due dates with your pay schedule

- Set up automatic payments to avoid late fees

- Budget for additional costs like medications or follow-up care

- Plan for time off work during surgical phases

For patients considering All-on-X dental implants, the financing timeline may be compressed since these procedures often involve fewer surgical phases.

Maximizing Your Investment in Dental Implants

Long-Term Cost Benefits

While the upfront cost of dental implants can seem daunting, especially when financing with bad credit, the long-term value often justifies the investment:

20-Year Cost Comparison:

- Dental Implants: $25,000 initial cost + minimal maintenance = ~$27,000 total

- Dentures: $3,000 initial + replacements every 5-7 years + adhesives = ~$15,000-20,000 total

- Bridges: $12,000 initial + replacement every 10-15 years = ~$24,000-36,000 total

Quality of Life Benefits:

- Improved nutrition from better chewing ability

- Enhanced confidence and social interactions

- Better oral health and reduced future dental costs

- No dietary restrictions unlike with dentures

Protecting Your Investment

Once you’ve secured dental implant financing bad credit approved and completed treatment, protecting your investment is crucial:

Essential Maintenance:

- Regular dental cleanings and checkups

- Proper oral hygiene with implant-specific products

- Avoiding harmful habits like smoking or teeth grinding

- Following post-surgical care instructions

Technology and Digital Financing Solutions

Online Application Platforms

The financing landscape has evolved significantly, with many lenders now offering streamlined online applications:

Advantages of Digital Applications:

- Instant pre-qualification decisions

- Secure document upload capabilities

- Real-time application status tracking

- Multiple lender comparisons in one platform

Popular Digital Platforms:

- Lending Tree Medical – compares multiple lenders

- Credible Healthcare – specialized medical financing marketplace

- Patient Fi – designed specifically for healthcare practices

Mobile Apps and Account Management

Many financing companies now offer mobile apps that make managing your dental implant financing easier:

Key Features:

- Payment scheduling and reminders

- Account balance tracking

- Document storage and access

- Customer service chat functions

Working with Insurance and Financing Together

Maximizing Insurance Benefits

Even with bad credit financing, you may be able to use dental insurance to reduce your overall costs:

Insurance Strategy:

- Use annual maximums strategically across treatment phases

- Understand waiting periods for major procedures

- Coordinate with HSA/FSA accounts for tax advantages

- Appeal denials with proper documentation

Common Insurance Coverage:

- Extractions: Usually covered at 70-80%

- Bone grafts: Often covered at 50% if medically necessary

- Implant placement: Limited coverage, typically 50% if covered

- Crowns: Usually covered at 50% with annual maximum limits

HSA and FSA Coordination

Health Savings Accounts and Flexible Spending Accounts can be powerful tools when combined with financing:

HSA Benefits:

- Tax-deductible contributions reduce taxable income

- Tax-free withdrawals for qualified medical expenses

- No “use it or lose it” rules – funds roll over annually

- Investment growth potential for long-term savings

FSA Considerations:

- Pre-tax payroll deductions reduce current tax burden

- Must use funds within plan year (with limited carryover)

- Can cover financing payments for qualified procedures

- Requires planning around treatment timeline

Conclusion

Securing dental implant financing bad credit approved is entirely possible with the right approach and knowledge. Throughout this comprehensive guide, I’ve shown you that poor credit doesn’t have to be a barrier to getting the dental implant treatment you need and deserve.

The key takeaways for success include exploring in-house financing options first, as these often have the most flexible approval criteria. Specialized medical lenders like CareCredit, Prosper Healthcare, and United Medical Credit focus on your ability to pay rather than just your credit score. Additionally, alternative funding sources such as dental schools, government assistance programs, and even crowdfunding can provide pathways to affordable treatment.

Remember that proper preparation significantly improves your approval chances. Gather all necessary documentation, optimize your debt-to-income ratio, and consider having a co-signer if needed. Don’t overlook the value of building relationships with dental financial coordinators who can guide you through available options.

Your Next Steps:

- Calculate your budget using the financing calculator above to understand realistic payment options

- Research local dental practices that offer in-house financing programs

- Gather your financial documentation including pay stubs, bank statements, and tax returns

- Apply to multiple lenders to compare terms and find the best fit for your situation

- Schedule consultations with dental practices to discuss treatment plans and financing options

Don’t let bad credit keep you from the confidence and health benefits that dental implants provide. With persistence and the right approach, you can find financing solutions that work for your situation. Start by exploring affordable dental implant options and take the first step toward your new smile today.

Leave a Reply

Share your thoughts or ask a question about dental implants. Your email address will not be published.